Section 2(14) of the Companies Act, 2013 defines “branch office”. It states that branch office in relation to a company, means any establishment described as such by the Company. The provisions for Appointment of Branch Auditor by a Company are given under Section 143(8) and Rule 12 of[...]

Read More

Section 123 of the Companies Act, 2013 (the Act) and the rules made thereunder deals with declaration of dividend. Section 123(1) of the Act provides that, Declaration of Dividend No dividend shall be declared or paid by a company for any financial year except — out of the[…]

Read More

A Service to preserve, protect and retrieve your company’s data virtually Businesses often face challenges in storing legal and compliance documents physically, with proper security and confidentiality. Such documents may need to be retrieved on the spur of the moment. Often, the storage of such documents becomes too[...]

Read More

Legal provisions of the Bonus Issue Section 63 of the Companies Act, 2013 provides about ‘Issue of Bonus Shares’. It states that – (1) A company may issue fully paid-up bonus shares to its members, in any manner whatsoever, out of— (i) its free reserves; (ii) the securities premium account; or (iii) the capital[…]

Read More

Consolidated FDI Policy by the Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry Following are relevant provisions of FDI policy of DPIIT in respect of trading activity: 100% FDI under Government approval route is allowed for retail trading, including through e-commerce, in[...]

Read More

Are you planning a holiday abroad ? Are you wondering how much currency you can carry with you? What are the allowed expenses on a foreign tour? Or maybe your child is going for education abroad. How you are going to fund him? Can you invest in foreign[...]

Read More

Debentures are debt instruments which may or may not be secured. It is a means of raising finances, one of the most common forms of long-term loans. But still, it is not a loan, as the names suggest, convertible debentures are instruments that gets converted into shares of[...]

Read More

In the Companies Act, 2013, though there is no specific definition of minority shareholders, from various provisions of the Act, we can state that minority shareholders are those, who are, in case of a company having share capital, not less than 100 members or not less than 1/10th[...]

Read More

Takeover of a Private Company Business Tool for Restructuring Company vis-a-vis LLP Comparison Company & Branch Office

Read More

Key employees of a Company can be awarded by issuing shares of the Company to give them ownership rights. We are discussing herewith three employee reward options of employee benefit plans – (1) Employee Stock Option Plans (ESOP) (2) Stock Appreciation Rights (SARs) or Phantom Stock and (3)[…]

Read More

The Ministry of Corporate Affairs has introduced certain new amendments to the existing Schedule III of the Companies Act, 2013 on 24th March, 2021, which requires the companies to make disclosures w.r.t key parameters pertaining to the business, in the Balance Sheet and Notes to Accounts. The said[...]

Read More

Can Private Limited Companies accept deposits? Yes, they can. Here are the provisions. I A Private limited company after passing of a resolution in general meeting can accept deposits from its members on such terms and conditions, including the provision of security, if any, or for the repayment of[...]

Read More

What is DIN-KYC? A DIN (Director Identification Number) is a unique identification number provided to all individuals who are willing to be at a Director position in a company. Designated partners of an LLP are also qualified to get a DPIN. A DIN is obtained via e-Form DIR[...]

Read More

The Ministry of Corporate Affairs (MCA) has recently notified amendment to Corporate Social Responsibility (CSR) provisions. These were introduced through the Companies (Amendment) Act, 2019, the Companies (Amendment Act), 2020 and also introduced Companies (Corporate Social Responsibility Policy) Amendment Rules, 2021. All these amendments are effective from 22nd[…]

Read More

The amendments to the Indian Stamp Act 1899 (Act) became effective on 1st July, 2020. They were initially recommended under the Finance Act 2019 and the Indian Stamp (Collection of Stamp-Duty through Stock Exchanges, Clearing Corporations and Depositories) Rules, 2019 (Rules). The intention behind the amendments is ease[…]

Read More

MSME Sector and Economic Stimulus Policy Revised Composite Criteria for registration as an MSME Type of Enterprise Micro Small Medium Manufacturing & Service Enterprises Investment in P & M up to Rs. 1 Crores AND Turnover up to Rs. 5 Crores Investment in P & M up to[…]

Read More

Conducting Board Meetings through VC Means Important points to be considered while conducting Board Meetings through Video Conferencing (VC) or any other Audio-Visual Mode: The notice calling the meeting must include an announcement that the meeting will be conducted through VC. The notice should also contain detailed procedure[...]

Read More

Things You Should Know before You Start a Business There are a few things one must consider before starting their own business. Whether it’s the Golden Circle by Simon Sinek, the customers you want to target, or the resources you need in order to get the[…]

Read More

You are aware of new compliance introduced by Ministry of Corporate affairs (MCA) in January 2019 in respect of onetime and half yearly returns by the Companies in respect of details of payment to Micro and Small Enterprise suppliers. Accordingly, now Companies have to file half yearly returns[...]

Read More

The Companies (Appointment and Qualification of Directors) Third Amendment Rules, 2019 have been notified w.e.f. 25th July 2019. As per the said notification yearly web based KYC has been introduced for all Directors/persons holding (DIN) to be completed on or before 30th September, 2019. Web-KYC will be verified[…]

Read More

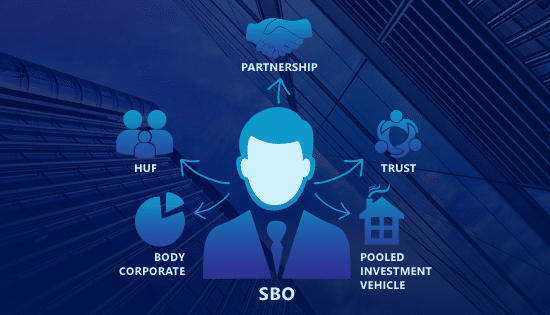

This is the second of a two part write-up on the Applicability of the Companies (SBO) Amendment Rules, 2019 4. SBO THROUGH INDIRECT HOLDING THROUGH SOME ENTITIES 5. COMPLIANCES AND TIMELINE Compliances Timeline Reporting Company to independently issue a notice to all members (being non[…]

Read MoreSearch

Recent Posts

- Branch Audit and Branch Auditor 11th Mar 2024

- Declaration of Dividend Out of Reserves 12th Sep 2023

- Introducing our Docu-Pool Service 29th Aug 2023