40/3 Flat No-102, Manikprabhu Apartment, Bhonde Colony, Erandawane, Pune 411004

+91 9145113311, +91 8668549082

csk@kelkarcs.com

Applicability of the Companies (SBO) Amendment Rules, 2019 – Part 2

Applicability of the Companies (SBO) Amendment Rules, 2019 – Part 2

This is the second of a two part write-up on the Applicability of the Companies (SBO) Amendment Rules, 2019

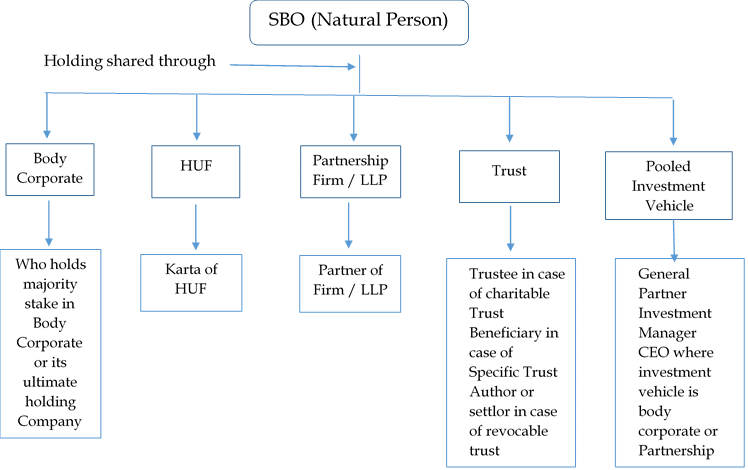

4. SBO THROUGH INDIRECT HOLDING THROUGH SOME ENTITIES

5. COMPLIANCES AND TIMELINE

| Compliances | Timeline |

| Reporting Company to independently issue a notice to all members (being non individuals) holding 10% more shares, voting rights, dividend/other distribution rights and to other prescribed persons in Form BEN-4, to obtain details of SBOs | No specific timeline prescribed. However, the process of identification of SBOs and securing declarations from the SBOs needs to be completed by 8th May 2019. Hence Companies need to start sending BEN 4 immediately now. |

| SBO to sign and file a declaration with the Company in Form BEN-1 (within 90 days from 8 February 2019) | By 8th May 2019 |

| Reporting Company to intimate the details of SBO to the Registrar of Companies (‘ROC’) in Form BEN-2. | Within 30 days from deployment of Form BEN 2 by MCA. Hence due date is 30th July, 2019 |

| Where any change in the SBO’s beneficial interest happens post the expiry of the initial 90 day period, SBO to declare the same to the Reporting Company in Form BEN-1. | Within 30 days of such change |

| If acquisition /change in SBO status happens during the first 90 days period i.e. prior to 8 May 2019 – SBO to provide declaration to Reporting Company in Form BEN-1 | By 6th June 2019 |

| In case of change in SBO status, Reporting Company shall also intimate the details of SBO to the Registrar of Companies (‘ROC’) in Form BEN-2 | Within 30 days of receipt of declaration from SBO |

| Company to maintain Register of SBOs in Form BEN-3 | Continuing compliance |

6. NON APLICABILITY of SBO RULES

SBO Rules shall not applicable in following cases:

- When all shareholders of Indian reporting Company are individuals/natural persons

- If shares of reporting Company are held by IEPF

- If shares of reporting Company are held by its holding reporting Company Provided that the details of such holding reporting company shall be reported in Form No. BEN-2.

- If shares of reporting Company are held by the Central Government, State Government or any local Authority;

- SEBI registered investment vehicle such as mutual funds, alternative investment funds, Real Estate Investment Trusts, Infrastructure Investment Trusts

- Investment vehicles regulated by RBI, IRDA or Pension Fund Regulatory and Development Authority

7. COMPLIANCES AND TIMELINE

If any SBO fails to make a declaration, he shall be punishable

- with imprisonment for a term which may extend to one year OR

- with fine which shall not be less than one lakh rupees but which may extend to ten lakh rupees OR

- with both

Where the failure is a continuing one, with a further fine which may extend to one thousand rupees for every day after the first during which the failure continues.

End of the two part write-up on the Applicability of the Companies (SBO) Amendment Rules, 2019

Search

Recent Posts

- Branch Audit and Branch Auditor 11th Mar 2024

- Declaration of Dividend Out of Reserves 12th Sep 2023

- Introducing our Docu-Pool Service 29th Aug 2023